Performance Coach. Psychotherapist. Trader.

I’m a psychotherapist with 22 years of clinical experience and 17 years of EMDR training. At Sound Performance Psychology, I work with traders whose strategy is solid but whose nervous system state keeps breaking it.

Most trading psychology fails because it targets behavior while ignoring the nervous system driving it.

I identify the schemas, attachment patterns, and threat responses sabotaging your execution, then build interventions that actually work when you’re activated.

Trading Psychology Rooted in Neuroscience

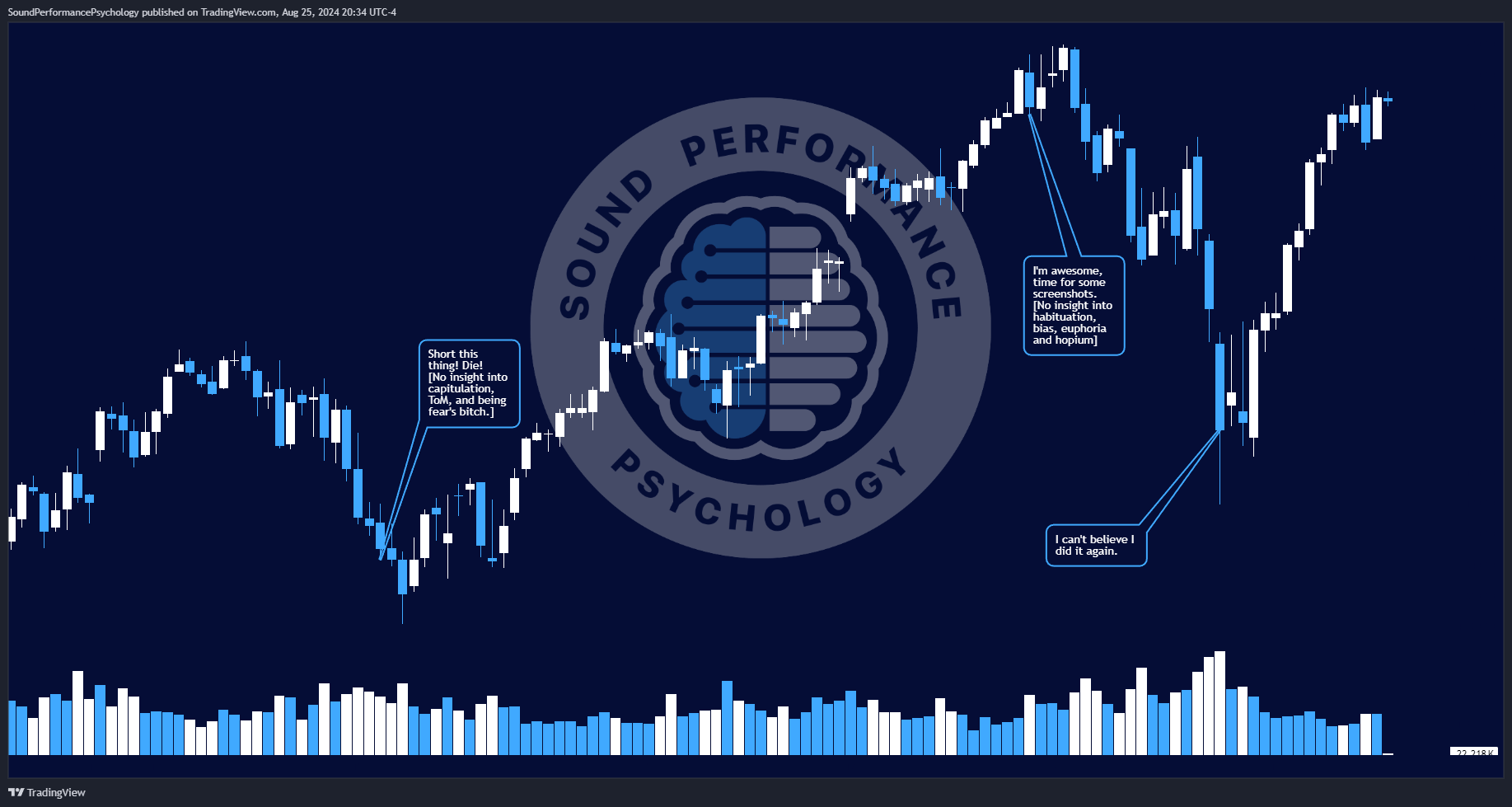

Your brain treats a drawdown like a physical threat. That’s why you freeze, revenge trade, or abandon your plan when you’re losing. The execution failure isn’t random; it’s your nervous system doing exactly what it’s designed to do.

My approach is not about making superficial changes. We delve deep into the early maladaptive schemas that are triggered by market conditions and rewire the conditioned responses that emerge when your threat system is activated. This process is transformative, offering you the opportunity to overcome the psychological patterns that override your strategy under pressure and significantly improve your trading performance.

Example: You can’t hold winners because cutting them feels safer than risking loss. That’s not discipline—it’s an abandonment schema. We use EMDR to reprocess the developmental memory driving the behavior, then rebuild your relationship with uncertainty through psychological flexibility work.

Or: You know FOMO drives you into bad trades, but cognitive strategies don’t stop it. We use “in vivo EMDR”—a technique that involves accessing your trading platform during sessions to activate your nervous system in real-time, then targeting the touchstone memories that created the pattern. You learn to recognize arousal spikes before they hijack decision-making.

Threat Detection Without Behavioral Collapse

Risk isn’t a spreadsheet problem. It’s a nervous system problem.

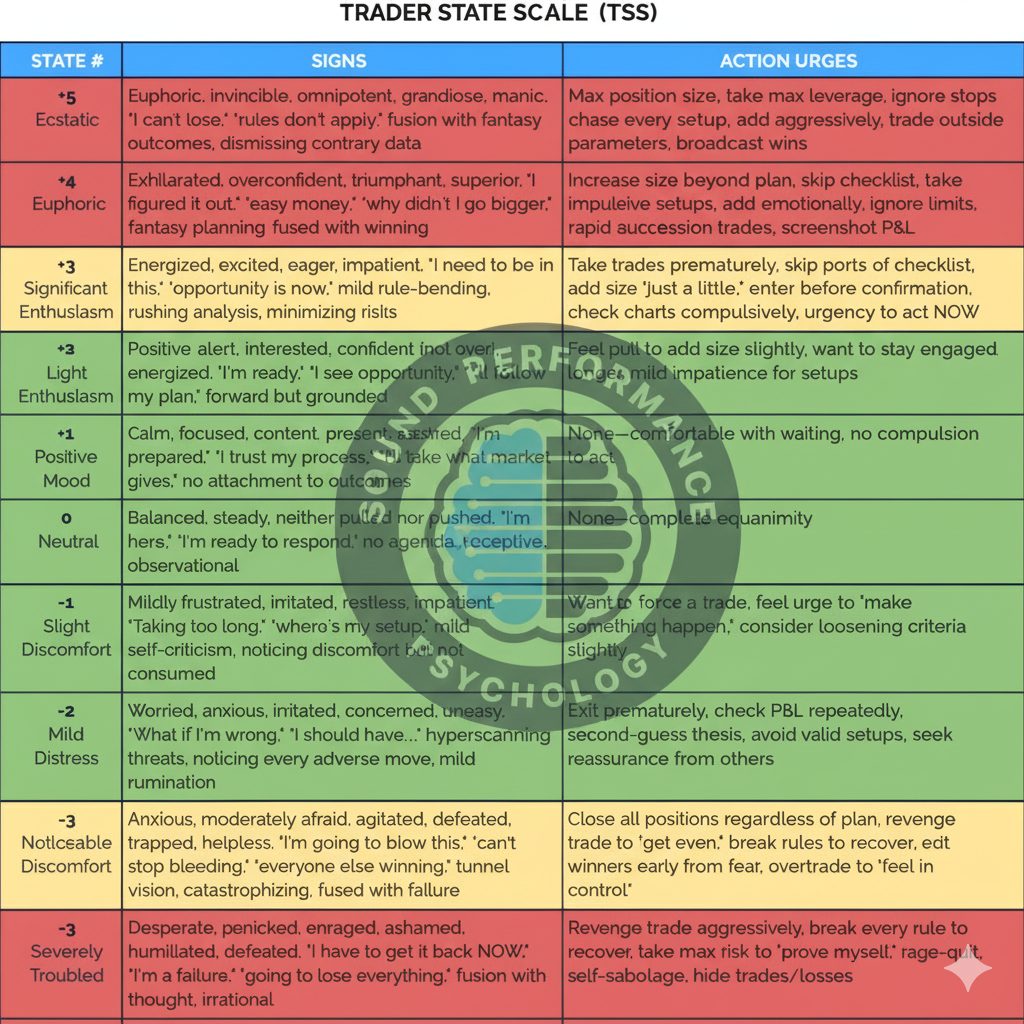

Skills developed in regulated states, which are states of calm and control, become inaccessible during activation. That’s why your edge disappears when you’re in a drawdown. I teach you to identify deep-rooted versus situational triggers, tolerate discomfort without reactivity, and maintain the ability to sit still when your body is screaming for action.

This requires working with the defensive modes that emerge under pressure—the parts of you that surrender (giving up on your plan), avoid (refusing to look at P&L), or overcompensate (engaging in revenge trading). We target these coping responses at their developmental origin, then build capacity to stay present with threat without collapsing into automatic patterns.

Accepting threat without reactivity is what separates consistent traders from everyone else who knows what to do but can’t do it.